Trading Tools

Trading Tools

At ICM Capital we continuously strive to offer you services which can support you when trading with us. Below you will find a Pip Calculator which can help you to calculate the value of a pip depending on the currency pair and the lot size of your transaction. You will also find a Pivot Calculator which is simple to use and designed to calculate Pivot Points in just seconds. After that, you can have access to the Economic Calendar which will help you to track the occurrence of market-moving events. Also, you will have the opportunity to use the Trading Signals on MT4 which can help you to subscribe to the signal feeds of other traders via their MT4 platform.

Economic Calendar

| GMT+1 | Currency | Event | Actual | Forecast | Previous | Imp. |

|---|---|---|---|---|---|---|

| 00:01 | GBP | Rightmove House Price Index (MoM) | 1.1% | 1.5% | ||

| 02:15 | CNY | China Loan Prime Rate 5Y (Apr) | 3.95% | 3.95% | 3.95% | |

| 02:15 | CNY | PBoC Loan Prime Rate | 3.45% | 3.45% | 3.45% | |

| 04:00 | NZD | Credit Card Spending (YoY) (Mar) | 1.4% | 2.1% | ||

| 05:00 | IDR | Export Growth (YoY) (Mar) | -4.19% | -9.60% | ||

| 05:00 | IDR | Import Growth (YoY) (Mar) | -12.76% | 15.84% | ||

| 05:00 | IDR | Trade Balance (Mar) | 4.47B | 0.83B | ||

| 08:00 | CHF | M3 Money Supply (Mar) | 1,136.9B | 1,131.5B | ||

| 10:00 | EUR | Government Budget to GDP | -3.6% | -3.7% | ||

| 10:00 | EUR | Government Debt to GDP | 88.6% | 90.8% | ||

| 11:00 | EUR | German Buba Monthly Report | ||||

| 11:00 | EUR | Eurogroup Meetings | ||||

| 11:10 | GBP | Rightmove House Price Index (YoY) (Apr) | 1.7% | 0.8% | ||

| 12:25 | BRL | BCB Focus Market Readout | ||||

| 13:00 | MXN | Economic Activity (YoY) (Feb) | 4.40% | 1.90% | ||

| 13:00 | MXN | Economic Activity (MoM) (Feb) | 1.40% | -0.90% | ||

| 13:30 | USD | Chicago Fed National Activity (Mar) | 0.15 | 0.09 | 0.09 | |

| 13:30 | CAD | IPPI (YoY) (Mar) | -0.5% | -1.4% | ||

| 13:30 | CAD | IPPI (MoM) (Mar) | 0.8% | 0.8% | 1.1% | |

| 13:30 | CAD | New Housing Price Index (MoM) (Mar) | 0.0% | 0.1% | 0.1% | |

| 13:30 | CAD | RMPI (YoY) (Mar) | 0.8% | -4.7% | ||

| 13:30 | CAD | RMPI (MoM) (Mar) | 4.7% | 2.9% | 2.1% | |

| 14:00 | EUR | French 12-Month BTF Auction | 3.474% | 3.471% | ||

| 14:00 | EUR | French 3-Month BTF Auction | 3.825% | 3.814% | ||

| 14:00 | EUR | French 6-Month BTF Auction | 3.710% | 3.706% | ||

| 15:00 | EUR | Consumer Confidence (Apr) | -14.7 | -14.0 | -14.9 | |

| 16:30 | USD | 3-Month Bill Auction | 5.255% | 5.250% | ||

| 16:30 | USD | 6-Month Bill Auction | 5.160% | 5.155% | ||

| 16:30 | EUR | ECB President Lagarde Speaks | ||||

| 22:00 | KRW | PPI (YoY) (Mar) | 1.6% | 1.5% | ||

| 22:00 | KRW | PPI (MoM) (Mar) | 0.2% | 0.3% |

| GMT+1 | Currency | Event | Actual | Forecast | Previous | Imp. |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Judo Bank Australia Manufacturing PMI (Apr) | 49.9 | 47.3 | ||

| 00:00 | AUD | Judo Bank Australia Services PMI (Apr) | 54.2 | 54.4 | ||

| 01:30 | JPY | au Jibun Bank Japan Manufacturing PMI (Apr) | 49.9 | 48.0 | 48.2 | |

| 01:30 | JPY | au Jibun Bank Japan Services PMI | 54.6 | 54.1 | ||

| 04:35 | JPY | 2-Year JGB Auction | 0.303% | 0.187% | ||

| 06:00 | INR | HSBC India Manufacturing PMI | 59.1 | 59.1 | ||

| 06:00 | INR | HSBC India Services PMI | 61.7 | 61.2 | ||

| 06:00 | JPY | BoJ Core CPI (YoY) | 2.2% | 2.3% | ||

| 06:00 | SGD | Core CPI (YoY) (Mar) | 3.10% | 3.60% | ||

| 06:00 | SGD | CPI (MoM) (Mar) | -0.10% | 1.10% | ||

| 06:00 | SGD | CPI (YoY) (Mar) | 2.7% | 3.1% | 3.4% | |

| 07:00 | GBP | Public Sector Net Borrowing (Mar) | 11.02B | 8.90B | 8.60B | |

| 07:00 | GBP | Public Sector Net Cash Requirement (Mar) | 20.739B | 3.236B | ||

| 08:00 | ZAR | Leading Indicators (Feb) | 112.80% | 110.80% | ||

| 08:15 | EUR | HCOB France Manufacturing PMI (Apr) | 44.9 | 46.9 | 46.2 | |

| 08:15 | EUR | HCOB France Composite PMI (Apr) | 49.9 | 48.3 | ||

| 08:15 | EUR | HCOB France Services PMI (Apr) | 50.5 | 48.9 | 48.3 | |

| 08:30 | EUR | HCOB Germany Composite PMI (Apr) | 50.5 | 48.6 | 47.7 | |

| 08:30 | EUR | HCOB Germany Manufacturing PMI (Apr) | 42.2 | 42.8 | 41.9 | |

| 08:30 | EUR | HCOB Germany Services PMI (Apr) | 53.3 | 50.6 | 50.1 | |

| 09:00 | GBP | MPC Member Haskel Speaks | ||||

| 09:00 | EUR | HCOB Eurozone Manufacturing PMI (Apr) | 45.6 | 46.5 | 46.1 | |

| 09:00 | EUR | HCOB Eurozone Composite PMI (Apr) | 51.4 | 50.8 | 50.3 | |

| 09:00 | EUR | HCOB Eurozone Services PMI (Apr) | 52.9 | 51.8 | 51.5 | |

| 09:15 | EUR | ECB Supervisory Board Member Fernandez-Bollo Speaks | ||||

| 09:30 | GBP | S&P Global/CIPS UK Composite PMI | 54.0 | 52.8 | ||

| 09:30 | GBP | S&P Global/CIPS UK Manufacturing PMI | 48.7 | 50.3 | 50.3 | |

| 09:30 | GBP | S&P Global/CIPS UK Services PMI | 54.9 | 53.0 | 53.1 | |

| 09:30 | HKD | CPI (MoM) (Mar) | 0.00% | 0.40% | ||

| 09:30 | HKD | CPI (YoY) (Mar) | 2.00% | 2.10% | ||

| 10:25 | EUR | Italian 2-Year CTZ Auction | 3.420% | 3.310% | ||

| 10:45 | EUR | German 2-Year Schatz Auction | 2.910% | 2.840% | ||

| 11:00 | EUR | Eurogroup Meetings | ||||

| 12:15 | GBP | BoE MPC Member Pill Speaks | ||||

| 12:30 | USD | Building Permits | 1.467M | 1.458M | 1.524M | |

| 12:30 | USD | Building Permits (MoM) | -3.7% | -4.3% | 2.4% | |

| 12:30 | EUR | German Buba President Nagel Speaks | ||||

| 13:55 | USD | Redbook (YoY) | 5.3% | 4.9% | ||

| 14:45 | USD | S&P Global US Manufacturing PMI (Apr) | 49.9 | 52.0 | 51.9 | |

| 14:45 | USD | S&P Global Composite PMI (Apr) | 50.9 | 52.1 | ||

| 14:45 | USD | S&P Global Services PMI (Apr) | 50.9 | 52.0 | 51.7 | |

| 15:00 | USD | New Home Sales (MoM) (Mar) | 8.8% | -5.1% | ||

| 15:00 | USD | New Home Sales (Mar) | 693K | 668K | 637K | |

| 15:00 | USD | Richmond Manufacturing Index (Apr) | -7 | -7 | -11 | |

| 15:00 | USD | Richmond Manufacturing Shipments (Apr) | -10 | -14 | ||

| 15:00 | USD | Richmond Services Index (Apr) | -13 | -7 | ||

| 17:00 | ZAR | SARB Monetary Policy Review | ||||

| 18:00 | USD | 2-Year Note Auction | 4.898% | 4.595% | ||

| 21:30 | USD | API Weekly Crude Oil Stock | -3.230M | 1.800M | 4.090M | |

| 22:00 | KRW | Consumer Confidence (Apr) | 100.7 | 100.7 | ||

| 23:45 | NZD | Exports (Mar) | 5.89B | |||

| 23:45 | NZD | Imports (Mar) | 6.11B | |||

| 23:45 | NZD | Trade Balance (MoM) (Mar) | -505M | -218M | ||

| 23:45 | NZD | Trade Balance (YoY) (Mar) | -11,990M |

| GMT+1 | Currency | Event | Actual | Forecast | Previous | Imp. |

|---|---|---|---|---|---|---|

| 00:50 | JPY | Corporate Services Price Index (CSPI) (YoY) | 2.1% | 2.1% | ||

| 02:30 | AUD | CPI (QoQ) (Q1) | 0.8% | 0.6% | ||

| 02:30 | AUD | CPI (YoY) (Q1) | 3.4% | 4.1% | ||

| 02:30 | AUD | CPI Index Number (Q1) | 136.10 | |||

| 02:30 | AUD | Trimmed Mean CPI (QoQ) (Q1) | 0.8% | 0.8% | ||

| 02:30 | AUD | Trimmed Mean CPI (YoY) (Q1) | 3.8% | 4.2% | ||

| 02:30 | AUD | Monthly CPI Indicator (YoY) (Mar) | 3.40% | 3.40% | ||

| 02:30 | AUD | Weighted mean CPI (YoY) (Q1) | 4.1% | 4.4% | ||

| 02:30 | AUD | Weighted mean CPI (QoQ) (Q1) | 0.9% | 0.9% | ||

| 08:00 | EUR | German Buba President Nagel Speaks | ||||

| 08:20 | IDR | Loans (YoY) (Mar) | 11.28% | |||

| 08:30 | IDR | Interest Rate Decision | 6.00% | 6.00% | ||

| 08:30 | IDR | Deposit Facility Rate (Apr) | 5.25% | 5.25% | ||

| 08:30 | IDR | Lending Facility Rate (Apr) | 6.75% | 6.75% | ||

| 09:00 | EUR | Italian Business Confidence (Apr) | 88.6 | |||

| 09:00 | EUR | Italian Consumer Confidence (Apr) | 96.9 | 96.5 | ||

| 09:00 | CHF | ZEW Expectations (Apr) | 11.5 | |||

| 09:00 | EUR | German Business Expectations (Apr) | 88.9 | 87.5 | ||

| 09:00 | EUR | German Current Assessment (Apr) | 88.7 | 88.1 | ||

| 09:00 | EUR | German Ifo Business Climate Index (Apr) | 88.9 | 87.8 | ||

| 09:15 | EUR | ECB Supervisory Board Member Tuominen Speaks | ||||

| 10:10 | EUR | Italian 6-Month BOT Auction | 3.765% | |||

| 10:30 | EUR | German 10-Year Bund Auction | 2.380% | |||

| 10:30 | EUR | German Buba President Nagel Speaks | ||||

| 11:00 | GBP | CBI Industrial Trends Orders (Apr) | -18 | |||

| 11:00 | GBP | CBI Industrial Trends Orders (Apr) | -16 | -18 | ||

| 11:00 | BRL | FGV Consumer confidence (Apr) | 91.3 | |||

| 11:00 | EUR | Eurogroup Meetings | ||||

| 12:00 | USD | MBA 30-Year Mortgage Rate | 7.13% | |||

| 12:00 | USD | MBA Mortgage Applications (WoW) | 3.3% | |||

| 12:00 | USD | MBA Purchase Index | 145.6 | |||

| 12:00 | USD | Mortgage Market Index | 202.1 | |||

| 12:00 | USD | Mortgage Refinance Index | 500.7 | |||

| 13:00 | MXN | 1st Half-Month Core CPI (Apr) | 0.16% | 0.33% | ||

| 13:00 | MXN | 1st Half-Month CPI (Apr) | -0.03% | 0.27% | ||

| 13:30 | USD | Core Durable Goods Orders (MoM) (Mar) | 0.3% | 0.3% | ||

| 13:30 | USD | Durable Goods Orders (MoM) (Mar) | 2.5% | 1.3% | ||

| 13:30 | USD | Durables Excluding Defense (MoM) (Mar) | 2.1% | |||

| 13:30 | USD | Goods Orders Non Defense Ex Air (MoM) (Mar) | 0.2% | 0.7% | ||

| 13:30 | CAD | Core Retail Sales (MoM) (Feb) | 0.0% | 0.5% | ||

| 13:30 | CAD | Retail Sales (MoM) (Feb) | 0.1% | -0.3% | ||

| 13:30 | CAD | Wholesale Sales (MoM) | 0.0% | |||

| 14:15 | EUR | ECB McCaul Speaks | ||||

| 15:00 | EUR | ECB's Schnabel Speaks | ||||

| 15:30 | USD | Crude Oil Inventories | 1.700M | 2.735M | ||

| 15:30 | USD | EIA Refinery Crude Runs (WoW) | 0.131M | |||

| 15:30 | USD | Crude Oil Imports | -1.991M | |||

| 15:30 | USD | Cushing Crude Oil Inventories | 0.033M | |||

| 15:30 | USD | Distillate Fuel Production | -0.038M | |||

| 15:30 | USD | EIA Weekly Distillates Stocks | -0.900M | -2.760M | ||

| 15:30 | USD | Gasoline Production | -0.025M | |||

| 15:30 | USD | Heating Oil Stockpiles | -0.714M | |||

| 15:30 | USD | EIA Weekly Refinery Utilization Rates (WoW) | -0.2% | |||

| 15:30 | USD | Gasoline Inventories | -1.400M | -1.154M | ||

| 17:30 | USD | Atlanta Fed GDPNow (Q1) | 2.9% | 2.9% | ||

| 18:00 | USD | 5-Year Note Auction | 4.235% | |||

| 18:30 | CAD | BOC Summary of Deliberations | ||||

| 18:30 | BRL | Foreign Exchange Flows | 1.962B | |||

| 22:00 | KRW | Manufacturing BSI Index (May) | 74 |

| GMT+1 | Currency | Event | Actual | Forecast | Previous | Imp. |

|---|---|---|---|---|---|---|

| 00:00 | KRW | GDP (YoY) (Q1) | 2.4% | 2.2% | ||

| 00:00 | KRW | GDP (QoQ) (Q1) | 0.6% | 0.6% | ||

| 00:50 | JPY | Foreign Bonds Buying | -1,005.9B | |||

| 00:50 | JPY | Foreign Investments in Japanese Stocks | 1,740.0B | |||

| 05:00 | IDR | M2 Money Supply (YoY) (Mar) | 5.30% | |||

| 06:00 | JPY | Coincident Indicator (MoM) | -1.2% | |||

| 06:00 | JPY | Leading Index (MoM) | 2.3% | -0.4% | ||

| 06:00 | JPY | Leading Index | 111.8 | 109.5 | ||

| 07:00 | EUR | GfK German Consumer Climate (May) | -25.9 | -27.4 | ||

| 07:00 | NOK | Unemployment Rate (Mar) | 3.6% | |||

| 07:45 | EUR | French Business Survey (Apr) | 102 | |||

| 08:00 | EUR | Spanish PPI (YoY) | -8.2% | |||

| 08:00 | EUR | ECB's Schnabel Speaks | ||||

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 09:30 | HKD | Exports (MoM) (Mar) | -0.8% | |||

| 09:30 | HKD | Imports (MoM) (Mar) | -1.8% | |||

| 09:30 | HKD | Trade Balance | -41.7B | |||

| 10:30 | ZAR | PPI (MoM) (Mar) | 0.5% | |||

| 10:30 | ZAR | PPI (YoY) (Mar) | 4.5% | |||

| 11:00 | GBP | CBI Distributive Trades Survey (Apr) | 5 | 2 | ||

| 11:00 | EUR | France Jobseekers Total | 2,811.9K | |||

| 12:30 | BRL | Current Account (USD) (Mar) | -4.37B | |||

| 12:30 | BRL | Foreign direct investment (USD) (Mar) | 5.01B | |||

| 13:00 | BRL | BCB National Monetary Council Meeting | ||||

| 13:30 | USD | Continuing Jobless Claims | 1,812K | |||

| 13:30 | USD | Core PCE Prices (Q1) | 2.00% | |||

| 13:30 | USD | GDP (QoQ) (Q1) | 2.5% | 3.4% | ||

| 13:30 | USD | GDP Price Index (QoQ) (Q1) | 3.0% | 1.7% | ||

| 13:30 | USD | GDP Sales (Q1) | 3.9% | |||

| 13:30 | USD | Goods Trade Balance (Mar) | -91.20B | -91.84B | ||

| 13:30 | USD | Initial Jobless Claims | 215K | 212K | ||

| 13:30 | USD | Jobless Claims 4-Week Avg. | 214.50K | |||

| 13:30 | USD | PCE Prices (Q1) | 1.8% | |||

| 13:30 | USD | Real Consumer Spending (Q1) | 2.8% | 3.3% | ||

| 13:30 | USD | Retail Inventories Ex Auto (Mar) | 0.4% | |||

| 13:30 | USD | Wholesale Inventories (MoM) | 0.2% | 0.5% | ||

| 13:30 | CAD | Average Weekly Earnings (YoY) (Feb) | 3.90% | |||

| 14:30 | BRL | Federal Tax Revenue | 186.50B | |||

| 15:00 | USD | Pending Home Sales (MoM) (Mar) | 0.9% | 1.6% | ||

| 15:00 | USD | Pending Home Sales Index (Mar) | 75.6 | |||

| 15:30 | USD | Natural Gas Storage | 50B | |||

| 16:00 | USD | KC Fed Composite Index (Apr) | -7 | |||

| 16:00 | USD | KC Fed Manufacturing Index (Apr) | -9 | |||

| 16:15 | EUR | German Buba President Nagel Speaks | ||||

| 16:30 | USD | 4-Week Bill Auction | 5.280% | |||

| 16:30 | USD | 8-Week Bill Auction | 5.275% | |||

| 16:45 | EUR | German Buba Mauderer Speaks | ||||

| 18:00 | USD | 7-Year Note Auction | 4.185% | |||

| 18:30 | BRL | Foreign Exchange Flows | 1.962B | |||

| 21:30 | USD | Fed's Balance Sheet | 7,406B | |||

| 21:30 | USD | Reserve Balances with Federal Reserve Banks | 3.330T |

| GMT+1 | Currency | Event | Actual | Forecast | Previous | Imp. |

|---|---|---|---|---|---|---|

| 00:01 | GBP | GfK Consumer Confidence (Apr) | -20 | -21 | ||

| 00:30 | JPY | CPI Tokyo Ex Food & Energy (YoY) (Apr) | 2.7% | 2.9% | ||

| 00:30 | JPY | Tokyo Core CPI (YoY) (Apr) | 2.2% | 2.4% | ||

| 00:30 | JPY | Tokyo CPI (YoY) (Apr) | 2.6% | 2.6% | ||

| 00:30 | JPY | CPI Tokyo Ex Food and Energy (MoM) (Apr) | 0.2% | |||

| 01:30 | SGD | URA Property Index (QoQ) | 1.50% | |||

| 02:30 | AUD | Export Price Index (QoQ) (Q1) | 5.6% | |||

| 02:30 | AUD | Import Price Index (QoQ) (Q1) | 0.1% | 1.1% | ||

| 02:30 | AUD | PPI (YoY) (Q1) | 4.1% | |||

| 02:30 | AUD | PPI (QoQ) (Q1) | 0.9% | |||

| 03:30 | JPY | BoJ Monetary Policy Statement | ||||

| 03:30 | JPY | BoJ Outlook Report (YoY) | ||||

| 04:00 | JPY | BoJ Interest Rate Decision | 0.10% | |||

| 06:00 | SGD | Industrial Production (MoM) (Mar) | -8.8% | 14.2% | ||

| 06:00 | SGD | Industrial Production (YoY) (Mar) | -1.5% | 3.8% | ||

| 07:00 | NOK | Core Retail Sales (MoM) (Mar) | 0.1% | |||

| 07:30 | JPY | BoJ Press Conference | ||||

| 07:45 | EUR | French Consumer Confidence (Apr) | 91 | |||

| 08:00 | EUR | Spanish Retail Sales (YoY) (Mar) | 1.9% | |||

| 08:00 | EUR | Spanish Unemployment Rate (Q1) | 11.70% | 11.76% | ||

| 09:00 | CHF | SNB Board Member Jordan Speaks | ||||

| 09:00 | EUR | ECB's De Guindos Speaks | ||||

| 09:00 | EUR | M3 Money Supply (YoY) (Mar) | 0.5% | 0.4% | ||

| 09:00 | EUR | Loans to Non Financial Corporations (Mar) | 0.4% | |||

| 09:00 | EUR | Private Sector Loans (YoY) | 0.3% | 0.3% | ||

| 12:30 | INR | FX Reserves, USD | 643.16B | |||

| 12:30 | BRL | Bank lending (MoM) (Mar) | 0.2% | |||

| 13:00 | MXN | Trade Balance (Mar) | -0.585B | |||

| 13:00 | MXN | Trade Balance (USD) (Mar) | -1.610B | |||

| 13:00 | MXN | Unemployment Rate (Mar) | 2.60% | |||

| 13:00 | MXN | Unemployment Rate n.s.a. (Mar) | 2.50% | |||

| 13:00 | BRL | Mid-Month CPI (YoY) (Apr) | 4.14% | |||

| 13:00 | BRL | Mid-Month CPI (MoM) (Apr) | 0.36% | |||

| 13:30 | USD | Core PCE Price Index (YoY) (Mar) | 2.6% | 2.8% | ||

| 13:30 | USD | Core PCE Price Index (MoM) (Mar) | 0.3% | 0.3% | ||

| 13:30 | USD | PCE Price index (YoY) (Mar) | 2.6% | 2.5% | ||

| 13:30 | USD | PCE price index (MoM) (Mar) | 0.3% | 0.3% | ||

| 13:30 | USD | Personal Income (MoM) (Mar) | 0.5% | 0.3% | ||

| 13:30 | USD | Personal Spending (MoM) (Mar) | 0.6% | 0.8% | ||

| 13:30 | USD | Real Personal Consumption (MoM) (Mar) | 0.4% | |||

| 13:30 | CAD | Manufacturing Sales (MoM) | 0.7% | |||

| 14:00 | USD | Dallas Fed PCE (Mar) | 3.40% | |||

| 15:00 | USD | Michigan 1-Year Inflation Expectations (Apr) | 3.1% | 2.9% | ||

| 15:00 | USD | Michigan 5-Year Inflation Expectations (Apr) | 3.0% | 2.8% | ||

| 15:00 | USD | Michigan Consumer Expectations (Apr) | 77.0 | 77.4 | ||

| 15:00 | USD | Michigan Consumer Sentiment (Apr) | 77.8 | 79.4 | ||

| 15:00 | USD | Michigan Current Conditions (Apr) | 79.3 | 82.5 | ||

| 16:00 | CAD | Budget Balance (YoY) (Feb) | -25.70B | |||

| 16:00 | CAD | Budget Balance (Feb) | -2.10B | |||

| 17:30 | USD | Atlanta Fed GDPNow | ||||

| 18:00 | USD | U.S. Baker Hughes Oil Rig Count | 511 | |||

| 18:00 | USD | U.S. Baker Hughes Total Rig Count | 619 | |||

| 18:00 | BRL | CAGED Net Payroll Jobs | 306.11K | |||

| 20:30 | GBP | CFTC GBP speculative net positions | 8.6K | |||

| 20:30 | USD | CFTC Aluminium speculative net positions | 1.0K | |||

| 20:30 | USD | CFTC Copper speculative net positions | 47.6K | |||

| 20:30 | USD | CFTC Corn speculative net positions | -204.9K | |||

| 20:30 | USD | CFTC Crude Oil speculative net positions | 290.5K | |||

| 20:30 | USD | CFTC Gold speculative net positions | 201.9K | |||

| 20:30 | USD | CFTC Nasdaq 100 speculative net positions | 8.5K | |||

| 20:30 | USD | CFTC Natural Gas speculative net positions | -131.9K | |||

| 20:30 | USD | CFTC S&P 500 speculative net positions | 74.1K | |||

| 20:30 | USD | CFTC Silver speculative net positions | 53.4K | |||

| 20:30 | USD | CFTC Soybeans speculative net positions | -171.9K | |||

| 20:30 | USD | CFTC Wheat speculative net positions | -62.9K | |||

| 20:30 | CAD | CFTC CAD speculative net positions | -82.8K | |||

| 20:30 | MXN | CFTC MXN speculative net positions | 127.7K | |||

| 20:30 | CHF | CFTC CHF speculative net positions | -36.2K | |||

| 20:30 | AUD | CFTC AUD speculative net positions | -101.1K | |||

| 20:30 | BRL | CFTC BRL speculative net positions | 0.9K | |||

| 20:30 | JPY | CFTC JPY speculative net positions | -165.6K | |||

| 20:30 | NZD | CFTC NZD speculative net positions | -11.7K | |||

| 20:30 | EUR | CFTC EUR speculative net positions | 12.2K |

| GMT+1 | Currency | Event | Actual | Forecast | Previous | Imp. |

|---|---|---|---|---|---|---|

| 02:30 | CNY | Chinese Industrial profit YTD (Mar) | 10.2% |

VPS Hosting for Forex Trading

This Virtual Private Server (VPS) is available for existing and new clients who maintain a balance of 4,000 USD or equivalent in EUR, GBP or SGD in their account. It allows Expert Advisors to be installed and run without interruption 24 hours a day whenever the markets are open. We've chosen to partner with Beeks FX, one of the global leaders in VPS solutions. If you are a FX trader who wants access to one of the fastest VPS services in the industry then you can get it with ICM Capital.

Key Features

Specifications

What is Pip?

A pip is the minimum price fluctuation of the instrument being priced. At ICM Capital we have introduced five digit quotes to allow our clients to benefit from smaller price increments and moves in the market. For instance, Instead of quoting prices with four digits. i.e EURUSD 1.3151/1.3153, we quote the pair at a lower spread of 1.3 as 1.31508/1.31524.

What is a lot?

A Forex Lot is the amount of currency you buy or sell. Say for example you wish to 100,000 USD, 100,000 is basically your trade size. Forex Lot is basically representation of Trade Size in a different format. A Standard Lot would represent 100,000 of any currency.

EUR 100,000 = 1 Standard Lot Euro

Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors. For example, if the currency underlying one of your trades moves against you, leverage will greatly amplify the potential losses. To help reduce the chance of such a scenario, forex traders usually implement a strict trading style that includes the use of stop and limit orders.

To help ensure accuracy please make sure the numbers you enter are in the correct format and include the correct amount of digits, for example EUR/USD we quote the pair at a lower fixed spread of 1.6 at say 1.31508/1.31524 with five digits not four 1.3151/1.3153.

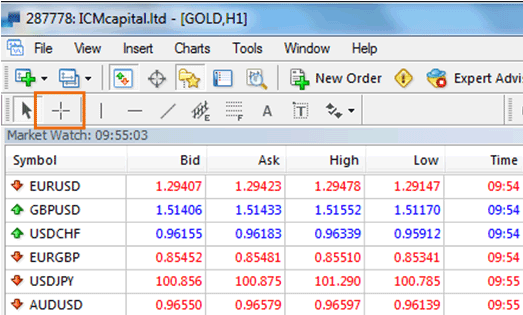

In order to calculate the pivot point you must take the Open, High, Low and Close price which can be found in the MetaTrader 4 platform by using the 'Crosshair' (the + sign on the top left hand corner) and moving it over the chart.

What is a Trailing Stop?

A Trailing Stop causes the level of the Stop Loss to trail the price level of a Buy or Sell position. Using a specified algorithm a Trailing Stop allows traders to maintain their open position and continue to achieve profits as long as the price moves in their favoured direction. Once Trailing Stops have been fixed they don't have to be altered manually, as a stop loss does.

Will the Trailing Stop work when I am offline?

Ensure that the MetaTrader 4 Client Terminal is running and that your device is connected to the internet when placing a Trailing Stop order, as it will only remain active when you are online. Once you close your trading platform your Trailing Stop order will be deactivated, while your Stop Loss order will remain active if it was placed before the Trailing Stop.

If you are new to Forex trading then Micro lots can be an ideal way for you to enter an exciting market that has a Daily turnover of over USD 5 trillion a day (as of April 2016). In Forex trading the minimum contract size for a micro account is 0.01 of a lot, which is equal to 1,000 units of the base currency.

At ICM Capital we do not treat clients differently depending on their deposit size, so this type of trading is open to all clients and is available on both our demo and live MT4 platforms.

We aim to continuously improve your trading environment and offer you the best possible service. If you have any questions please do not hesitate to get in touch with our award-winning Client Services team.

Key Features

How to Access Trading Signals?

Becoming a Signal Provider

ICM Capital’s advanced traders with a successful trading strategy can use Trading Signals to their advantage. Simply register here as a ‘Seller’ by filling in the requested data in the registration form. Once registration is complete you can sell your signals to thousands of subscribers around the world. Please note there are no costs to register as a Signal Provider however it takes 30 days for your track record to be verified by MetaQuotes before you can add a fee to your service.

Click here for the user guide on becoming a Signal Provider: User guide

Are Trading Signals Secure?

MetaQuotes has designed this advanced software to ensure each trade features a digital signature that prevents the trade from being copied incorrectly. Trades triggered by a provider’s signals are copied on the subscriber’s account in a way that reflects the money management rules used by the signal provider. Signal Providers are paid a fixed monthly subscription fee.

How do I choose a signal provider?

Choose a signal provider which is using a Live Account and see how many trades have been executed. Generally, if a signal provider has performed 100 or more trades it shows that this is an active account. Clients should be aware of the drawdown percentage, less than 30% is thought to be ideal. Follow traders with a steady growth rate. If the growth is high very quickly, the signal provider may be trading in a high-risk manner. Finally, you may find that paid signals are more reliable in the long run. If you choose to follow a Signal Provider who charges for the signals, you can be sure that the Signal Provider has partaken in a 30 day trial period and has been verified by MetaQuotes before being able to start charging for the owned signals.

How can I manage my risk with Trading Signals?

Manage each signal you are following as if it were an individual trade and ensure, when you subscribe to a Signal Provider that you set parameters to manage your risk on each trade. Have a strategy in place to choose how much of your account is dedicated to each Signal Provider. Ensure within your strategy you have a clear exit tactic and have rules in place for when you will stop following each signal.

Disclaimer

MetaQuotes Software Corp. is a respected third party software development company however the information provided should not be considered as trading advice. ICM Capital provides the opportunity for clients to follow trading signals to support clients in their trades, however each Signal Provider should be independently evaluated. ICM Capital will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.